Starting a business is not easy. In fact, your odds of survival are about 50/50, but there are some steps you can take to maximize your chances of success!

5 Steps:

Introduction

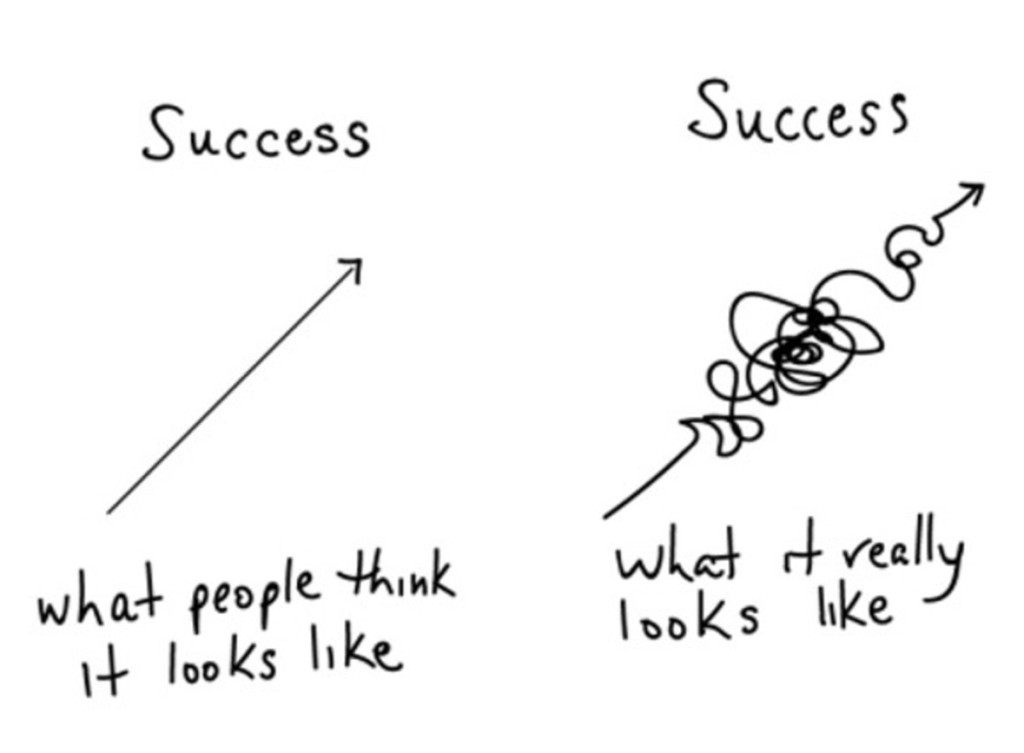

Elon Musk famously quoted a friend saying, “starting a business is like staring into the abyss and eating glass.”

Not very encouraging, but there is truth in this statement. Starting a business is hard. It will take longer than you think, it will cost more than you think and the odds of success may not be in your favor.

Starting a business requires both preparation and execution. Far too many aspiring entrepreneurs and small business owners don’t put enough time into the preparation. It’s critical to brainstorm, research the market trends, competition and determine how you will succeed.

“By failing to prepare, you are preparing to fail.” – Benjamin Franklin

And once you have done your homework and put the time in, it’s time to execute, and that is when the real work starts. All of the sudden the glamor of starting a business fades and the reality of raising money, creating a brand, building a website, hiring, payroll, taxes, attorneys, etc. all take their toll.

Small business owners who survive and thrive never give up and just keep chipping away every day. It’s not easy, but if you’re willing to put in the work and sacrifice, you too can be a successful business owner

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.” – Seth Godin

Failure Rates

The goal here is not to scare you away from starting a business, but you should understand the odds of success before you quit your job and mortgage your house.

“In God we trust. All others must bring data.” -W. Edwards Deming

For better or worse, consider these facts about starting a business, courtesy of the U.S. Bureau of Labor Statistics.

- 20% of small businesses fail within the first year

- 30% of small businesses fail within the second year

- 50% of small businesses fail within five years

- 70% of small businesses fail within 10 years

- 80% of small businesses fail within 20 years

Obviously your success or failure will depend a myriad of factors and circumstances, but on average half of all small businesses fail within five years. There are ways to increase your odds of success and we will cover some of those tips and insights.

Pursuing a Passion

“If you really look closely, most overnight successes took a long time.” – Steve Jobs

In order to have the energy and fortitude it will take to make your business a success, you will need to pursue an endeavor that you’re passionate about. You do not need to pursue a singular passion, but you do need to pursue something you are passionate about because that will be what powers you through to success.

Simply put, being an entrepreneur is too hard not to pursue a passion. If you chase down an idea or start a business for the purpose solely of making money or gaining recognition, it will be nearly impossible to sustain though the long, lonely, miserable times.

So as you decide what type of business you want to start, keep asking yourself, “Is this something I would be excited to wake up and work on every day for the next five years?”

Skills and Background

One of the greatest mutual fund managers of all time, Peter Lynch, always recommended that investors find your edge. Said differently, he urged people not to invest in businesses you don’t understand. Instead, he evangelized putting your money and effort into things you know more than the average person.

For example, let’s say you’re a director in a 3rd party logistics business and you’ve been in the shipping industry for nearly 10 years. If that’s the case, you should focus your investments on logistics and shipping businesses as opposed to the next breakthrough cancer drug that you no nothing about!

The same is true for staring a business. Now, that’s not to say you should completely avoid starting a business you don’t have a background in, but your odds of success will be greatly improved if you stick with industries you intimately understand.

That said, don’t lose site of the virtue #1 – pursing your passion!

Business vs. Hobby

Pursuing a passion is a must, and sticking to industries you understand will greatly increase your chances of success, but in order to succeed in business you need to generate sales!

“Without customers, you don’t have a business. You have a hobby.” -Don Peppers and Martha Rogers

Now you may hear fancy academic terms like “product market fit” or “price elasticity of demand” but the only thing that really matters is sales. Is someone willing to pay for your product or service?

There are a lot fun ideas and projects you can spend your time on, but if you want to start a successful business then you need to build something that provides value to your customers that they’re wiling to pay for.

5 Steps to Starting Your Business

1 – Brainstorming

Not all ideas are created equal, but as legendary entrepreneur, Sir Richard Branson famously stated, “Business opportunities are like buses, there’s always another one coming.”

Many people mistakingly believe that the idea is the key element for startups success. The idea is obviously important, but an idea alone is essentially worthless. Your success will be based 99.9% on the execution. However, a bad idea can be detrimental and prevent you from having any success regardless how hard you work. So as you brainstorm ideas for your startup consider the following factors:

- Passion – is this something you would love working on?

- Skills & Background – is this something you have skills or a background in?

- Unique – is your idea unique or are you building another social network?

- Market – will people pay for your product or service? how’s the competition?

- Barriers – are there any regulations, legal or technical hurdles?

As you brainstorm business ideas it’s critical to keep in mind that a great business model in a bad market is doomed to fail and a mediocre business model in a great market will most likely succeed. So as you evaluate ideas, remember that big, growing markets are where you want to focus.

2 – Testing Your Idea

Once you’ve settled on an idea you’re passionate about, the first step is to test your thesis. The easiest way to do this is to interview at least 10 potential customers of your product or service. This will help you refine your pitch and gather invaluable feedback.

For example, let’s say you’re looking to create a SaaS business that helps financial advisors market their services online. You have a list of features and benefits and plan on selling it for $30/month. The next step would be to get feedback from at least 10 financial advisors and pitch your business to see if they’d be willing to pay $30/month for your service.

You’re going to get a ton of valuable feedback and after speaking to 10 or more potential customers you will have a better sense of whether you have a viable business idea or not. Do they need what you’re building? Is someone else already doing it well? Is it valuable enough they would pay $30/month? Perhaps they will pay more?

Most entrepreneurs don’t make it past this point because it takes real effort! It’s not fun sticking your neck out and cold-calling 50 potential customers to get in touch with 10 and then pitching them your idea. But, if you make it past this step, you’ve done what 90% of wantrapreneurs aren’t willing to do. And your odds of success will increase dramatically.

“The way to get started is to quit talking and begin doing.” – Walt Disney

3 – Business Plan

At this point you’ve vetted your idea and it’s time to pin down the details and create your business plan.

Even if you’re not raising money, creating a business plan will force you to get organized and think through the details of your business model. It will become your strategic blueprint and guide your path to success.

Your business plan does not need to be shared, but it can be a great tool to share your story to investors, customers and vendors. You can create a business plan in a Word.doc, Power Point, email… the point is to have it in a format that you can edit over time because things will change and evolve over time!

10 Elements of a Great Business Plan

- Elevator Pitch (mission) – what is your business in one sentence? sounds easy but it’s harder than it looks!

- Problem (customer pain) – what is the current customer problem?

- Solution (opportunity) – how are you going to fix the customer problem? why will people pay for your product or service?

- Timing – why is now the right time for your solution? did you know the first electric car was developed in 1828, but electric cars really didn’t become commercially viable until nearly 200 years later!

- Market Potential – what compelling statistics can you share about your market to illustrate the size and potential growth of the market you’re pursuing? if it’s a new market, even better!

- Competition – who are your direct and indirect competitors? why will you win?

- Business Model – what product or service are you selling? how will you make money? what’s unique about what you’re doing?

- Sales & Marketing – how will you get the word out and acquire customers? what story will you tell?

- Team – who is on your team? what roles do you need to be successful? do yo have co-founders?

- Financials – how do you make money? what are your unit economics? how much revenue do you expect to generate? monthly? annually? what are your expenses? how much money will you need to achieve your goals?

More Business Plan Help

4 – Business Setup

Once you have your business plan ironed out it’s time to set up your actual business. First, you need to determine whether you will have partners or not. Some company structures allow for one owner, while others require multiple members or shareholders.

| Structure | Members | Key Highlights |

| Sole Proprietorship | 1 | No separation between you and the business |

| Limited Partnership | 2+ | One general partner with unlimited liability |

| Limited Liability Partnership | 2+ | Limited liability to every owner |

| Limited Liability Company | 1+ | Simple, very flexible structure |

| C Corp | 1+ | Very sophisticated, usually for larger businesses |

| S Corp | 1+ | Like a C Corp but taxes pass through to owners |

| B Corp | 1+ | Like a C Corp but taxed differently |

| Close Corporation | 1+ | Like a B Corp with less traditional corporate structure |

| Nonprofit Corporation | 1+ | Nonprofits can receive tax-exempt status |

| Cooperative | 2+ | Owned and operated by those using its services |

The second consideration when choosing a business structure is whether or not you will be raising money from outside investors or not. If you do raise money you will most likely need to create an operating agreement for an LLC or articles of incorporation for a C Corp. These documents define the rules for your business and owner rights.

Once you figure out these three elements you can select a structure and file with the Secretary of State where you live. But before you do, we highly recommend you seek guidance from a CPA and a small business attorney to make sure you minimize your tax liability and set up all documents properly. You don’t want to be cheap at this stage and then have to pay to clean everything up down the road!

5 – Funding

Every new business requires funding of some sort, and depending on your plan, you may only need $5k or you might need $5mm. There are a half dozen ways to fund your business depending on how much money you need and what stage your business is in.

Equity Financing Options

- Self-funded – Pretty straightforward, you provide the capital needed to get started and operate the business. You can use savings or borrow against your assets. However, we encourage only using savings and not spending too much that it impacts your personal life and well being!

- Bootstrapping – Collect customer down-payments, presales, company credit cards, side hustle, vendor terms, etc. Bootstrapping is any way you can think to creatively fund your business as you grow.

- Friends and Family – Raising $5k-25k from friends and family is a very common way to get started. You would pitch your business plan and they would invest in your company. This is easier than finding outside investors because friends and family know and trust you already.

- Angel Investors – These are sophisticated individuals who are accredited and typically invest anywhere between $25k-$500k in startup businesses. They will require a bit more convincing than friends and family but a good angel investor can help and open doors.

- Venture Capital – Only 2% of new businesses get venture funding, so don’t get your hopes up! VC’s typically invest $2mm-$50mm in businesses that have some traction, a great team and can grow toward a $1 billion+ exit, very rare to get VC funding considering there are over 500k businesses started every year and less than 1k receive VC funding.

- Private Equity – PE firms only invest in mature, cash-flow generating businesses, they typically invest $5mm-$500mm and will hold for five to seven years. Some private equity is permanent capital, which most typically comes from family offices or endowments.

- IPO – Less than 0.1% of businesses make it to this point. In fact, only about 300 per year in the U.S. Once a business becomes big and mature enough to take on public investment you can IPO and sell your stock to the general public.

Debt and Other Financing Options

- Grants – Depending on the nature of your business and personal situation, you may be eligible for grants, although this is not very common or reliable and can take months or even years. That said, it’s worth a look before you raise money.

- SBA Loans – For early-stage businesses the U.S. government will back bank loans based on your personal assets (house, investments, etc.). This can be a non-dilutive way to grow your business but keep in mind you’ll be on the hook personally for the loans.

- Banks Loans – As the old saying goes, if you need money, a bank will not lend it to you, and if you don’t need money, they’ll throw it at you. Truth is, unless you have two to three years of operating profit, a bank loan is out of the question when starting out.

Raising money is a necessary evil, it’s not the end goal. You want to be capital efficient, raise as little as possible and keep as much ownership in your business as possible.

Your First Dollar

The entire goal of starting a business is to make money, so after you set up your business, all of your effort should be driven toward generating that first sale. The first dollar doesn’t sound like much, but once you have someone actually pay you for what you’re doing then you’re officially in business.

The first dollar is a milestone that many entrepreneurs don’t reach and it’s the beginning of your journey to building a great company.

Exit Strategy

Every business is different and your goals are as unique as you! All things considered, the best exit strategy is not to have an exit strategy at all. Put another way, you should build a business that makes you pop out of bed every morning!

There is a lot of press out there touting venture-backed unicorns and billionaire founders. There is nothing wrong with having billion dollar ambitions, but for most small business owners, simply starting a company that provides a great living for your family and your employees is a real win!

So you shouldn’t build a company with the goal of selling it, rather, you should build a company you are excited to own and run for the long-term. And then if someone comes along and wants to buy it, you can make that decision at that point.

In Conclusion

Starting a business is not easy. In fact, it can be one of the hardest things you ever do. But, if you have the itch, and you’re willing to put in the work, starting a business and working for yourself is the closest thing to freedom and enjoyment you can experience in your career. The real question is, are you serious about putting in the effort or are you just a wantrapreneur?

Only you can answer that question.

Leave a comment